WHY WE'RE DIFFERENT

Cashfac’s unique Operational Cash SaaS Platform

Cashfac is an operational cash management solution configured for the digital age – cloud and open banking ready tools that provide organizations with agility, flexibility and scalability

Cloud deployed with open source technologies

Our cloud capabilities ensure fast efficient deployment, and enables real-time data. We use Open source technologies such as Kubernetes and RabbitMQ to enable rapid scalability

Advanced integration

Our advanced integration includes 2-way APIs for integrating with user’s existing business and accounting. We have API-connected UX, offering custom-built UX for end customer self-service source technologies

Multi-banking and multi entity

M&A and organic growth across regions means firms need agility, multi banking and ease of bank switching. Cashfac provides critical multi-entity capability and bespoke UX by entity

High volume payments

Cashfac can execute all payment types. Payments are initiated by integrated customer systems or authorised customer clerical processes

Fast delivery with rules driven configuration

Low-touch delivery in under 2-6 months. Cashfac is a rules-driven extensible platform where sector-specific rules are pre-configured. The rules can be tailored to specific client needs and the solution can be operated on client’s cloud / servers

End-customer self service infrastructure

We offer seamless, real-time customer self-service and connectivity. Resilience, technical convergence and message queuing is key to our end-customer self-service infrastructure

Cashflow forecast and predictive reconciliation

Cashfac’s forward cash architecture projects the forward cash flows and clears down the transactions as settled. Forward transactions and balances are automatically reconciled to maximise operational efficiencies

Open Banking ready

Cashfac provides an Open Banking API and model mobile cash management app (Software Development Kit available by arrangement)

Cashfac is an operational cash management solution configured for the digital age – cloud and open banking ready tools that provide organizations with agility, flexibility and scalability

Cloud deployed with open source technologies

Our cloud capabilities ensure fast efficient deployment, and enables real-time data. We use Open source technologies such as Kubernetes and RabbitMQ to enable rapid scalability

Advanced integration

Our advanced integration includes 2-way APIs for integrating with user’s existing business and accounting. We have API-connected UX, offering custom-built UX for end customer self-service source technologies

Multi-banking and multi entity

M&A and organic growth across regions means firms need agility, multi banking and ease of bank switching. Cashfac provides critical multi-entity capability and bespoke UX by entity

High volume payments

Cashfac can execute all payment types. Payments are initiated by integrated customer systems or authorised customer clerical processes

Fast delivery with rules driven configuration

Low-touch delivery in under 2-6 months. Cashfac is a rules-driven extensible platform where sector-specific rules are pre-configured. The rules can be tailored to specific client needs and the solution can be operated on client’s cloud / servers

End-customer self service infrastructure

We offer seamless, real-time customer self-service and connectivity. Resilience, technical convergence and message queuing is key to our end-customer self-service infrastructure

Cashflow forecast and predictive reconciliation

Cashfac’s forward cash architecture projects the forward cash flows and clears down the transactions as settled. Forward transactions and balances are automatically reconciled to maximise operational efficiencies

Open Banking ready

Cashfac provides an Open Banking API and model mobile cash management app (Software Development Kit available by arrangement)

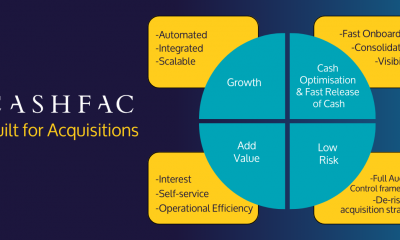

Why choose Cashfac?

Our powerful and reliable Virtual bank Technology (VBT) is the world's most deployed Virtual Account Management (VAM) solution

-

10+

Bank partners

-

700+

Corporate customers

-

700k+

Customer accounts

-

5m+

Payments initiated annually

-

40bn+

Payments initiation value annually

RESOURCES

News & Blog

Navigating Vendor Selection: Ensuring Future-Proof Solutions for Banks

What are some of the concerns we've heard from banks selecting escrow, business, and commercial banking self-service virtual account solutions?

Read more

News & Blog

For Hassle-Free Client Money Bank Change, Contact Cashfac

This blog explores the benefits and challenges of changing banks for client cash management, focusing on wealth managers, trusts, and non-bank financial intermediaries. It highlights

Read more

News & Blog

Private Equity is changing the landscape of UK PLC through innovation and investment in transformational leadership

Cashfac is helping Private Equity firms investing in the Pensions, Property and Wealth Management sectors deliver value, fast.

Read more

Talk to us today

To find out more about how Cashfac's capabilities can help your business, get in touch with our helpful team